Bankruptcy: The Gateway To Credit Recovery

GET THE FACTS!!!

GET THE FACTS!!!

by John G. Merna

The biggest misconception about bankruptcy is that it is “bad” and destroys your credit. These

MYTH #1 (Most Common):

Bankruptcy destroys your credit. Wrong!

Most people’s credit is destroyed before they file bankruptcy due to late payments, foreclosures, judgments, etc. In my 18 years of practicing bankruptcy, I can count the number of people on my fingers who were still current on their debt when they came to consult with me. Chances are if you are reading this article you are also already

FACT #1:

Bankruptcy is the gateway to rebuilding your credit.

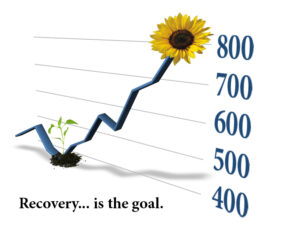

In reality, bankruptcy is like a knife that cuts the cord that is holding down or dragging down your credit score. Once the cord is cut your credit score is free to start floating to the surface. Your score will rise automatically as much as 100 points in the year following the filing of your bankruptcy. It will rise higher and fast if you enroll in and work an organized, efficient, and tailored

So to recap – Bankruptcy is not what has destroys credit. The defaulted debt that drives people into a bankruptcy is what has destroyed their credit. Bankruptcy cuts loose that bad credit reporting and lets your score start to improve. So why is there a persistent urban legend that bankruptcy destroys your credit for 10 years?

MYTH #2:

Bankruptcy Destroys Your Credit For 10 Years. Wrong again!

The law allows credit reporting agencies to list a Chapter 7 bankruptcy filing on your report for up to ten years and Chapter 13 for up to seven. So why isn’t that a problem? Because ….

FACT #2:

The reporting on your credit report is not your “credit”. Your credit score is technically your “credit”. Your credit score is your Beacon or FICO score, which gives a numeric summary of the reporting by giving numeric weigh to things like late payments, types of accounts, length of credit, amount of credit, etc. After a history of late or non-payment and the filing of a

MYTH #3:

Filing bankruptcy drives your credit score to zero. Wrong Once Again!

Bankruptcy has two effects on your credit. The first is it is reported in the public records section on your credit reports. The second is it halts all reporting of accounts listed in your bankruptcy. (Emphasis on “accounts listed in your bankruptcy”. If you are working with an attorney who does not pull your credit reports or you do not provide your credit

FACT #3:

The true numeric effect of a bankruptcy on a credit score is that the score bounces. When you file bankruptcy the reporting of the filing can have a point effect from 0 to 100 depending on your score. The higher the score, the higher the point effect. If your score is extremely low then it will have little to no effect initially. Immediately after the

Crazy isn’t it. Bankruptcy actually helps your credit score and your ability to recover. Ssssshhhh. It is our secret. Don’t tell your friend or relatives who are struggling with the stress of not being able

Bankruptcy is good or more accurately I should say “does good” or “has a good effect”. You can ask the

If you enjoyed this article I would appreciate if you would click the Google+1 at the top of the page to help others find it on the internet. God bless.